When the organization responsible for collecting £800 billion in annual revenue decides to tear down its digital infrastructure and start fresh, business leaders should pay attention.

HMRC (His Majesty’s Revenue and Customs) isn’t just buying new software; they are fundamentally rethinking how a massive enterprise interacts with automation. In a move that signals a major shift in public sector strategy, HMRC has selected SAP to overhaul its core revenue systems.

Here is why this matters for your business strategy, regardless of your industry.

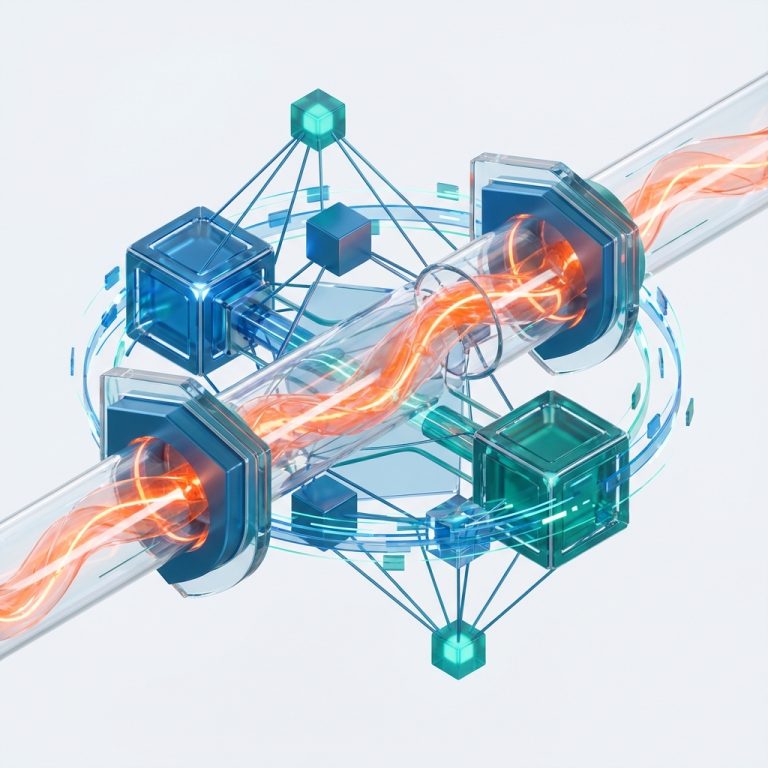

The Problem with “Bolting On” AI

For the last few years, the trend has been to layer Artificial Intelligence tools on top of existing legacy systems. It’s a quick fix. It looks good in a pitch deck. But it rarely works at scale.

HMRC faced a classic dilemma: they manage over 45 different tax regimes on a fragmented, on-premise landscape. Trying to run sophisticated machine learning on disconnected data silos is like trying to drive a Formula 1 car on a dirt track.

Instead of the band-aid approach, they are replacing the underlying architecture—specifically the Enterprise Tax Management Platform (ETMP)—to support automated decision-making natively. They are moving to a managed cloud environment (SAP’s RISE) to unify their data.

Data Sovereignty is Non-Negotiable

For founders in regulated industries (finance, healthcare, legal), the hesitation to adopt AI often comes down to one thing: security.

HMRC’s approach offers a blueprint for navigating this. They are deploying these commercial AI capabilities on SAP’s UK Sovereign Cloud. This ensures that while they benefit from global tech innovation, the data never leaves the distinct legal and security boundaries of the UK.

It proves that high compliance standards and high-tech innovation are no longer mutually exclusive.

The Business Takeaway: Infrastructure First

The lesson here isn’t about tax; it’s about the link between data accessibility and operational value.

If you want your teams to make decisions based on real-time analytics, you cannot rely on patchwork systems. Effective AI requires unified data sets. If your data is trapped in different departments or incompatible software, your AI has nothing to learn from.

Key insights for your roadmap:

- Stop layering, start integrating: AI shouldn’t be an afterthought; it needs to be part of the foundation.

- Address technical debt: You cannot scale automation on top of broken or outdated processes.

- Focus on the user: The end goal of this massive HMRC update isn’t just “better tech”—it’s reducing friction for the taxpayer.

HMRC is betting that the future belongs to organizations that treat AI as an infrastructure challenge, not just a software purchase. It is a bet worth emulating.